‘Tis the Season for Giving

by Judy Held

The generosity of those who invest in the mission of the Catholic Foundation of Eastern Montana makes all the difference. There is no better time of year for benefiting the Catholic causes you love while creating tax savings and other benefits for you and your family.

There are many simple ways to support the Church before the end of the year. These three charitable giving options could come in handy in a few months when your taxes are due!

1. Make an outright gift today.

Put your generosity into action and receive income tax savings by making an outright gift to a permanent endowment at the Catholic Foundation of Eastern Montana. Outright gifts may reduce your taxable income, and outright gifts from businesses may qualify for the Montana Endowment Tax Credit. Any amount makes a difference—no gift is too small!

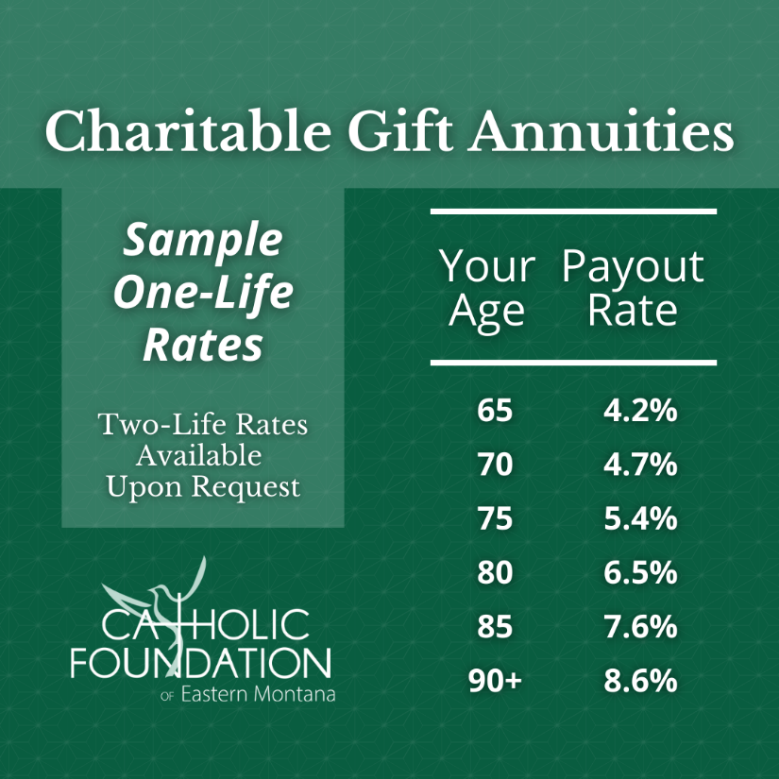

2. Fund a Charitable Gift Annuity and create a new income source for yourself.

When you create a Charitable Gift Annuity at the Catholic Foundation of Eastern Montana, you are investing in your future and the future of the Church.

Lock in great rates and receive excellent tax benefits—and best of all, know that your gift is securing a vibrant future for the Catholic parishes, schools, and ministries you love.

3. Satisfy your required minimum distribution with an IRA Charitable Rollover.

If you own an IRA and are at least 70 ½ years of age, you are eligible to transfer any amount (up to $100,000 per year) directly from your IRA to the Catholic Foundation of Eastern Montana.

This is often referred to as a Qualified Charitable Distribution (QCD) and, once you reach 72 years of age, can be used to satisfy your Required Minimum Distribution without increasing your taxable income!

Here’s how the IRA Charitable Rollover works:

- Call the Foundation at 406-315-1765 so we can help you specify the permanent endowment you wish to support with your IRA Charitable Rollover. Your gift is given now but will last forever!

- Call your IRA administrator and tell them you want to make an IRA Charitable Rollover.

- Have your IRA administrator send your distribution directly to the Catholic Foundation of Eastern Montana. Since the distribution is transferred directly from your IRA to the Foundation, it is not taxable income, nor does it create a tax deduction. You benefit even if you don’t itemize!

Questions about the Montana Endowment Tax Credit, IRA Charitable Rollover, or any other year-end giving options? Contact Judy Held, Foundation President, at 406-315-1765 or [email protected].

Take advantage of the Montana Endowment Tax Credit.

Montana taxpayers who make a planned gift for any of the Foundation’s 125+ permanent endowments may receive a tax credit equal to 40% of the charitable value of their gift—wow! This is a dollar-for-dollar reduction of the Montana tax you may owe for 2021.

Hundreds of Catholics in Eastern Montana take advantage of this credit every year. We would be happy to help you direct your eligible gift for the everlasting benefit of your most beloved Catholic cause located within our diocese. Reach out to Judy Held, Foundation President, to learn more and ensure you receive this impressive benefit!