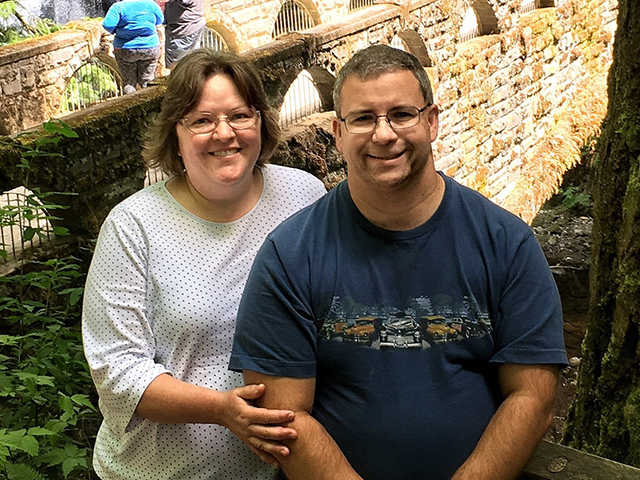

To pay our blessings forward Matt and Erin Ginnaty on a visit to Bellingham, Washington. Here at the Catholic Foundation of Eastern Montana, we love to hear the stories of why our donors decide to build (or, in some cases, create) permanent endowments for the Catholic Church in our diocese....

Read More